A private student loan is a financing option for higher education in the United States that can supplement, but should not replace, federal loans, such as Stafford loans, Perkins loans and PLUS loans. Private loans, which are heavily advertised, do not have the forbearance and deferral options available with federal loans (which are never advertised). In contrast with federal subsidized loans, interest accrues while the student is in college, although repayment may not begin until after graduation. While unsubsidized federal loans do have interest charges while the student is studying, private student loan rates are higher, sometimes much higher. Fees vary greatly, and legal cases have reported fees reaching 50% of amount of the loan. Although traditionally unsecured, these loans are increasingly secured, so that the borrower must offer collateral or a third-party guarantee of repayment.

Interest rates and loan terms are set by the financial institution that underwrites the loan, typically based on the perceived risk that the borrower may be delinquent or in default of payments of the loan. The underwriting decision is complicated by the fact that students often do not have a credit history that would indicate creditworthiness. As a result, interest rates may vary considerably across lenders, and some loans have variable interest rates.

Unlike other consumer loans, Congress made student loans, both federal and private, exempt from discharge (cancellation) in the event of a personal bankruptcy. This is a serious restriction that students rarely appreciate when obtaining a student loan.

Financial aid, including loans, may not exceed the cost of attendance.

Maps, Directions, and Place Reviews

Parallels to mortgage lending

The increase in use of private student loans came about around 2001 once the increase in the cost of education began to exceed the increase in the amount of federal student aid available.

The recent history of student loans has been compared to the history of the mortgage industry. Similar to the way in which mortgages were securitized and sold off by lenders to investors, student loans were also sold off to investors, thereby eliminating the risk of loss for the actual lender.

Another parallel between the student loan industry and the mortgage industry is the fact that subprime lending has run rampant over the past few years. Just as little documentation was needed to take out a subprime mortgage loan, even less was needed to take out a subprime or "non-traditional" student loan.

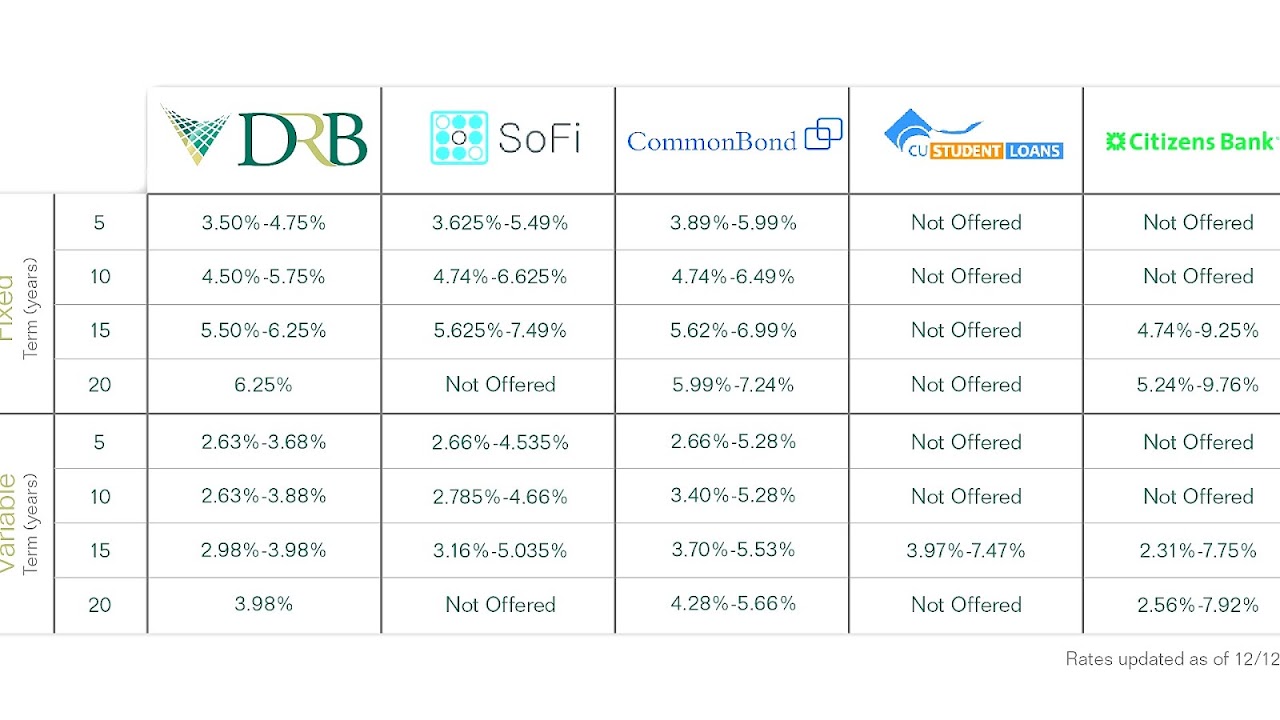

Private Student Loan Banks Video

Criticisms

After the passage of the bankruptcy reform bill of 2005, even private student loans are not discharged during bankruptcy. This provided a credit-risk-free loan for the lender, averaging 7 percent a year.

In 2007, the Attorney General of New York State, Andrew Cuomo, led an investigation into lending practices and anti-competitive relationships between student lenders and universities. Specifically, many universities steered student borrowers to "preferred lenders" which resulted in those borrowers incurring higher interest rates. Some of these "preferred lenders" allegedly rewarded university financial aid staff with "kickbacks." This has led to changes in lending policy at many major American universities. Many universities have also rebated millions of dollars in fees back to affected borrowers.

The biggest lenders, Sallie Mae and Nelnet, are criticized by borrowers. They frequently find themselves embroiled in lawsuits, the most serious of which was filed in 2007. The False Claims Suit was filed on behalf of the federal government by former Department of Education researcher, Dr. Jon Oberg, against Sallie Mae, Nelnet, and other lenders. Oberg argued that the lenders overcharged the U.S. Government and defrauded taxpayers of millions and millions of dollars. In August 2010, Nelnet settled the lawsuit and paid $55 million.

The New York Times recently published an editorial endorsing the return of bankruptcy protections for private student loans in response to the economic downturn and universally increasing tuition at all colleges and graduate institutions.

A recent report (2014) from Consumer Financial Protection Bureau (CFPB), shows a rising problem with these types of loans. Borrowers face "auto-default" when cosigner dies or goes bankrupt. The report shows that some lenders demand immediate full repayment upon the death or bankruptcy of their loan cosigner, even when the loan is current and being paid on time.

Participants

The biggest student loan lender, Sallie Mae, was formerly a government-sponsored entity, which became private between 1997-2004. A number of financial institutions offer private student loans, including banks like Wells Fargo, and specialized companies. Student loan search and comparison websites allow visitors to evaluate loan terms from a variety of partner lenders, and financial aid offices in universities typically have a preferred vendor list, but borrowers are free to obtain loans wherever they can find the most favorable terms.

As the economy collapsed in 2008-2011, many players withdrew from the private student loan lending world.. The remaining lenders tightened the credit criteria, making it more difficult to receive a loan. Most now require a credit-worthy cosigner. After the economic collapse of 2008, a number of peer-to-peer lending and alternative lending platforms emerged to help students find private student loans. For example, U.S. online marketplace lending platform LendKey allows consumers to book loans directly from community lenders like credit unions and community banks.

Choosing a lender

Barring exceptional circumstances, all U.S. citizens and residents should use Federal student loans, which have lower interest and better terms, in preferance to private loans.

Relevant factors in choosing a private lender include:

- Interest rates throughout the life of the loan - interest may accrue at one rate while the student is in school and another after graduation

- Payment options - lenders typically offer loans on which repayment begins immediately; loans on which only the interest must be paid while the student is enrolled; and loans with no payments until graduation or withdrawal from school. In the latter case, the unpaid interest while in school is capitalized (added to the balance due).

- Incentives - lenders may offer improved terms based on the student's payment record

- Origination fees - lenders typically charge a fee for originating the loan; the fee is added to the principal (amount borrowed).

The total cost of the loan is documented in the Truth in Lending statement, which the borrower should receive when the loan is originated.

Source of the article : Wikipedia

EmoticonEmoticon